About Us

Tax and the Family was set up by Don Draper and Leonard Beighton, both with many years of experience advising on tax policy, in order to advance an understanding of the way the tax system works for families and to promote changes which would make the tax system fairer for families. Tax and the Family Charitable Trust has been accepted by HMRC as a charity and can accept GiftAided donations. The organisation is non-profit and provides information, guidance and consultation for anyone involved in tax policy and families. We depend on individual donations for support to carry out our work. If you wish to make a donation please click here.

To view our trustee’s annual report, please click here.

We do not advise on individual cases. The data is, to the best of our knowledge and belief, correct as at the date it was uploaded. We will attempt to keep the data up to date but we cannot guarantee this.

Email address: info@taxandthefamily.org

Media enquiries: 07856211788.

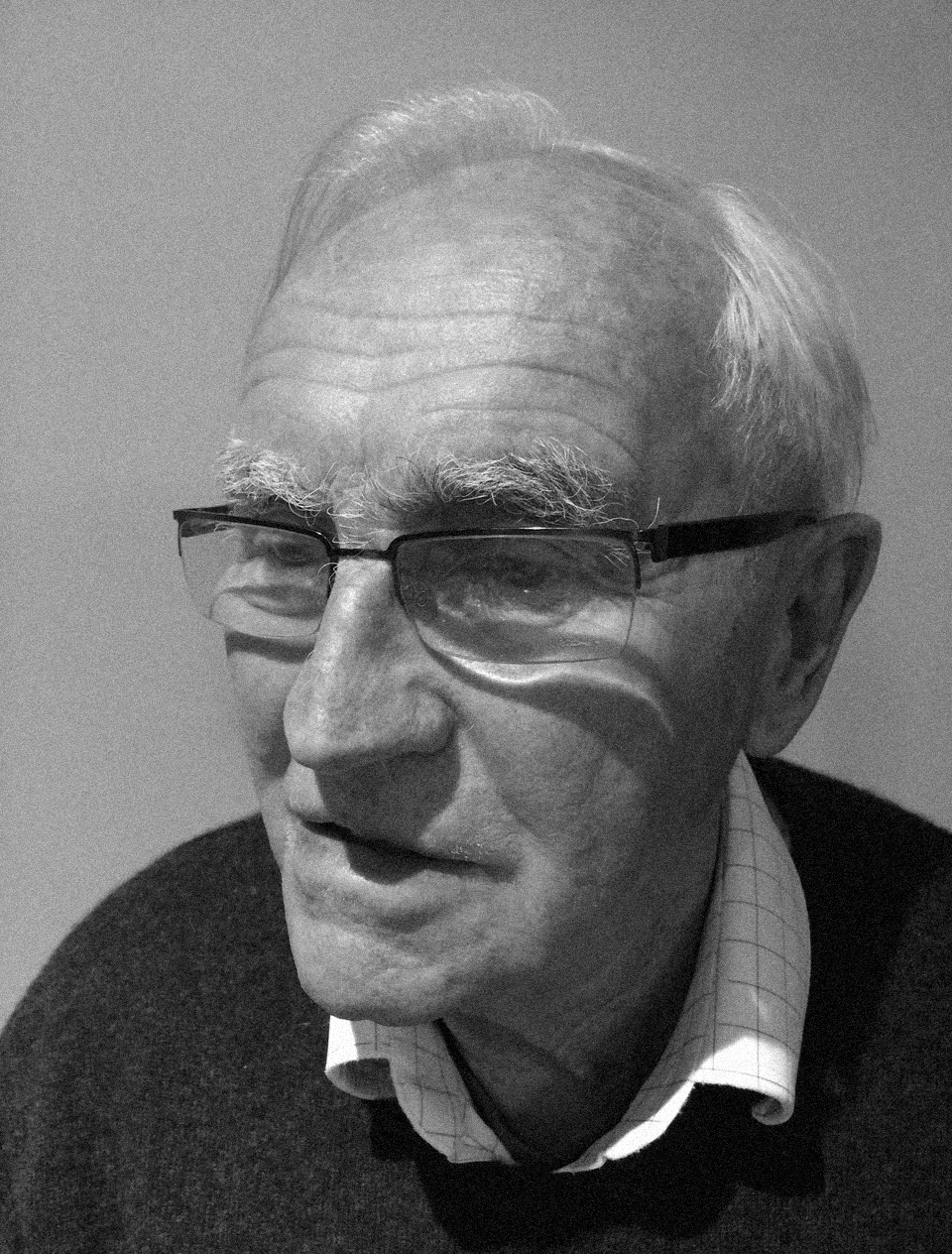

Leonard Beighton

Co-founder

Leonard Beighton was Deputy Chairman of the Board of Inland Revenue from 1992 to 1994. In retirement he has continued to work on taxation in a variety of forums. He is an honorary fellow of the Chartered Institute of Taxation.

You can watch an interview with Leonard regarding his time at the Inland Revenue here.

Don Draper

Co-founder

Don Draper worked in the Inland Revenue for 23 years on tax policy before moving to PricewaterhouseCoopers. In retirement he has written on the taxation of the family.

John Avery Jones

John Avery Jones is a retired Judge of the Upper Tribunal (Tax and Chancery Chamber). From 1988 he was a visiting professor at the London School of Economics and was an editor of the British Tax Review for over 20 years. He is a leading authority on international tax law who has also taken an interest in family tax. He is a trustee of the Tax and the Family Charitable Trust.

Alistair Pearson

Alistair Pearson is a management consultant with an interest in the effectiveness of public policy. He is the coordinating editor of an annual review of the taxation of families in the UK and other OECD countries published by social policy charity CARE.